Why in news:

A recent report submitted to the Rajya Sabha reveals that 5,892 cases have been taken up under the Prevention of Money Laundering Act (PMLA) 2002 by the Enforcement Directorate (ED) since 2015. However, only 15 convictions have been secured by special courts, raising serious concerns about the effectiveness of PMLA enforcement and misuse of the law.

UPSC CSE UPSC CSE Relevance:

General Studies-III: money-laundering and its prevention.

2021 Mains

Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels.

2013 Mains

Money laundering poses a serious threat to country’s economic sovereignty. What is its significance for India and what steps are required to be taken to control this menace?

Money Laundering

Black Money

- Money which breaks laws in its origin, movement or use and is not reported for tax purposes, is called black money.

- Illegal in origin – Drug trafficking, corruption, human trafficking, prostitution etc

- It also includes that money on tax is evaded or statutory requirements are not followed, for example, money generated by running a firecrackers factory with children working as labors.

- Legal provisions to deal with black money

- Prevention of Money Laundering Act 2002

- Laundered money can be attached and seized

- Individuals and entities indulging in ML can be prosecuted

- Imprisonment of minimum 3 years upto 7 years and a fine of Rs 5 Lakh

- MLAT used to recover such proceeds

- Foreign Exchange management Act 1999 (Related to limited capital account convertibility in India, make contravention a civil offence)

- Foreign exchange transaction contravening the limits imposed by the government can be adjudicated with penalty upto a maximum 3 times of the amount involved

- Such money and assets can be confiscated and repatriated

- Section 105 of CrPC – provides reciprocal arrangement and procedure for forfeiture of properties generated from commission of an offence

- Under Income tax Act evading tax is subject to penalty and prosecution

- Prevention of Money Laundering Act 2002

- Strategy to tackle black money

- Prevent generation – online transactions and KYC norms and reporting large transactions

- Discourage use – amnesty schemes

- Effective detection – Tracing the money trail

- Effective investigation and adjudication – increase the capacity and manpower of Enforcement Directorate, FIU, CBI and increase international cooperation

- Regulate use of large denomination

Money Laundering (ML)

- The process of creating the appearance that large amount of money obtained from serious crimes, such as drug trafficking or terrorist activity, is from legitimate sources is called money laundering

- Or simply process of making dirty money look like clean money is called money laundering

- Link with terrorism

- Those who fund terrorist groups use laundering route to avoid getting caught by investigating agencies

- Terrorists use laundering route to operationalize their activities such as booking plane tickets, purchasing weapons online

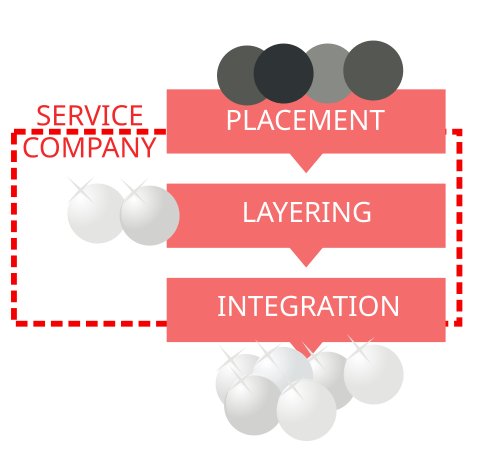

- Three step process

- Placement

- Riskiest step where launderers inserts the money into formal financial channel

- Banks are required to report large transactions

- Layering

- Sending the money through various financial transactions to change its form and make it difficult to trace

- Bank to bank transfer, international transactions, investment into shell companies, donations to political parties, purchasing high value items etc

- Integration

- Money re-enters the system. Now it appear to come from legitimate sources

- Purchase Properties stated under value, Create trusts -receive donations

Round-tripping

Money leaves the country through various channels such as inflated invoices, payments to shell companies overseas, the hawala route and so on. Invested in many shell companies or other assets in the foreign country. Comes back to India in the form of P-Notes, Global depository receipts or even offshore investments in shell companies of India.

Trade based ML (TBML)

Process of transferring or moving dirty money through trade transactions

Techniques of TBML

Shipping scrap and pricing it at a premium by claiming it is A grade material. Thus legitimizing the proceeds of the crime. Over-invoicing and under-invoicing of goods and services

Over-invoicing example – selling a painting for 100 Rs but showing that it was sold for Rs. 1 Lakh. Thus legitimizing the proceeds of crime

Under-invoicing example – buying a property for Rs 10 Lakh but showing that it was brought for Rs 1 Lakh only. Thus using proceeds of crime as an investments

Multiple-invoicing of goods and services: Transaction is done multiple times on paper under various instruments

Over-shipment and under-shipment of goods and services: Similar to over or under invoicing however instead of doctoring the amounts the quantities are manipulated. Example – saying that I got 100 wooden sofa sets shipped from Myanmar. Whereas actually only 10 might have been shipped and rest were bought locally.

Effects of ML

Economic

- Unaccounted money artificially increases money flow in the economy leading to inflation or stock price rise

- When law enforcement agencies begin taking action – such money fades away leading to fall in stock prices

- Local businesses are at disadvantage since such money has paid lesser taxes coming from tax haven.

- Possible harm to the reputation of banks and the market.

- Measurement mistake causes policy distortion.

- When firms compete, they lose because there is no fair competition.

- Organised crime may do well in the area.

- It also makes doing business more expensive, which hurts small enterprises more than others.

- Changes in interest rates and exchange rates that happen because of unexpected money transfers.

- Money laundering operations cause relative asset commodity prices to be misallocated.

- Insider trading, fraud, and embezzlement have made people lose faith in the markets and discourages foreign investment since corporations don’t like a lot of corruption.

- Higher insurance premiums for people who don’t make false claims and higher costs for businesses are other indirect economic repercussions. These things make it harder for firms to break even because they make less money.

- Because of these bad effects, policymakers have a hard time coming up with good ways to deal with monetary risks, which makes it hard for the government to manage its economic strategy.

- All of the foregoing would cause fake inflation, jobless growth, income disparity, poverty, and other problems that would make society less safe in the end.

Social

- Criminal activities proliferate as avenues of ML are successful

- Law abiding citizens are at disadvantage and transfers the economic power from the right people to the wrong ones.

- Loss of morality and ethical standards leading to weakening of social institutions.

- Increased unemployment as legitimate business companies fail to compete with operators operating through illegal money.

Political Impact

- Affects the government’s capability to spend on development schemes thereby affecting a large

section of populations who could have benefitted from such spending. - Legislative bodies find it difficult to quantify the negative economic effects of money laundering

on economic development and its linkages with other crimes – trafficking, terrorism etc.

Security Impact

- The quest to legalize illicit earnings spawns money laundering, which in turn provides the required financial boost for these illegal activities to survive. Several large-scale illegal activities such as arms dealing, organized crime, terrorist financing, as well as drug and sex trafficking, do not just drive money laundering but thrive on it.

- Usually terrorist organisations receive funds from other countries, those funds cannot be transferred easily through formal banks, so terrorists use hawala transaction for receiving and sending all the funds

Prevention of Money Laundering

Mechanisms created by INDIA

Prevention of Money Laundering Act 2002

- Money laundering linked to predicate scheduled offences is liable to be punished. Offence of Money Laundering is not an independent crime. It depends on ‘predicate offence’

- 156 such offences under 28 different Statutes.

- Predicate offence part is taken up by agency either CBI, Customs or state police. It’s money laundering part is handled by Enforcement Directorate.

- ED ascertains proceeds of crime and can initiate seizure and attachment of laundered property. This action is adjudicated by Adjudicating authority (AA) established under PMLA

- Special courts can provide for imprisonment from 3 years to 7 years and a fine upto 5 Lakh Rs. The property attached can be confiscated by AA after the conviction by the special court for scheduled offence.

- Burden of proof is on the accused. Statements recorded by ED Officers admissible.

- Procedures of Mutual Legal assistance is provided in the act for seizure and attachment of the property. India has signed MLAT with 26 countries.

- Section 12 of PMLA requires financial sector entities to verify the identity of their clients and report suspicious transactions to FIU-IND. FIU-IND is empowered to take action against such entities which fail to comply with this section.

Financial Intelligence Unit

- It was set by the Government of India in 2004 as the central national agency responsible for receiving, processing, analyzing and disseminating information relating to suspect financial transactions.

- FIU-IND is also responsible for coordinating and strengthening efforts of national and international intelligence, investigation and enforcement agencies in pursuing the global efforts against money laundering and related crimes.

- FIU-IND is an independent body reporting directly to the Economic Intelligence Council (EIC) headed by the Finance Minister.

Egmont Group of Financial Intelligence Units

It is an informal group of national FIUs. National FIUs collect information on suspicious or unusual financial activity from financial industry and other entities required to report suspicious transactions.

Global mechanisms to Combat Money Laundering:

Vienna Convention

It was the first major initiative in the prevention of money laundering held in December 1988. This convention laid down the groundwork for efforts to combat money laundering by obliging the member states to criminalize the laundering of money from drug trafficking. It promotes international cooperation in investigations and makes extradition between member states applicable to money laundering.

The Council of Europe Convention

This convention held in 1990 establishes a common policy on money laundering to facilitate international cooperation as regards investigative assistance, search, seizure and confiscation of the proceeds of all types of criminality, particularly serious crimes such as drug offences, arms dealing, terrorist offences etc. which generate large profits. It sets out a common definition of money laundering and common measures for dealing with it.

Basel Committee’s Statement of Principles

In December 1988, the Basel Committee on Banking Regulations and Supervisory Practices issued a statement of principles which aims at encouraging the banking sector to adopt common position in order to ensure that banks are not used to hide or launder funds acquired through criminal activities.

The Financial Action Task Force (FATF)

The FATF is an inter-governmental body established at the G7 summit at Paris in 1989 with the objective to set standards and promote effective implementation of legal, regulatory and operational measures to combat money laundering and terrorist financing and other related threats to the integrity of the international financial system. It has developed a series of recommendations that are recognized as the international standards for combating money laundering and the financing of terrorism. They form a basis for a coordinated response to these threats to the integrity of the financial system and help ensure a level playing field.

United Nations Global Programme against Money Laundering (GPML)

GPML was established in 1997 with a view to increase effectiveness of international action against money laundering through comprehensive technical cooperation services offered to Governments.

The programme encompasses following 3 areas of activities, providing various means to states and institutions in their efforts to effectively combat money laundering.

Three further Conventions have been adopted for Money Laundering related crimes:

- International Convention for the Suppression of the Financing of Terrorism (1999).

- UN Convention against Transnational Organized Crime (2000).

- UN Convention against Corruption (2003).

Challenges in prevention of money laundering

- Rapid advancements in digital technology: The enforcement agencies are not able to match up with the speed of growing technologies which enables money launderers to obscure the origin of proceeds of crimes by cyber finance techniques.

- Predicate-offence-oriented law: This means a case under the Act depends on the fate of cases pursued by primary agencies only such as the CBI, the Income Tax Department or the police. (Predicate offence- any offence that is component of more serious offence).

- Lack of awareness about seriousness of crimes of money-laundering: The poor and illiterate people, instead of going through lengthy paper work transactions in Banks, prefer the Hawala system where there are fewer formalities, little or no documentation, lower rates and anonymity.

- Non-fulfilment of the purpose of KYC Norms: Increasing competition in the market is forcing the Banks to lower their guards and thus facilitating the money launderers to make illicit use of it in furtherance of their crime.

- Involvement of employee of financial institution: Financial institutions are supposed to check the source of funds, monitor the activities on accounts, and track irregular transactions but usually an employee of the financial institution is involved making it easier to launder.

- Lack of comprehensive enforcement agencies: The offence of money laundering is borderless and has expanded its scope to many different areas of operation. In India, there are separate wings of law enforcement agencies dealing with money laundering, terrorist crimes, economic offences etc. and they lack convergence among themselves.

- Tax Haven Countries: They have long been associated with money laundering because their strict financial secrecy laws allow the creation of anonymous accounts while prohibiting the disclosure of financial information. Furthermore, there is strong evidence indicating that a substantial portion of these funds has been used to sustain terrorist groups such as Al-Qaeda.

Way Forward

- Make money laundering a separate criminal offence to be investigated by the Enforcement Directorate, irrespective of a probe by other agencies.

- Risk assessment: Financial institutions should undertake a risk assessment prior to the launch of the new products, business practices or the use of new or developing technologies.

- Follow ‘Client Due Diligence Process’ as envisaged under PMLA 2002: based on specific parameters related to the overall policy for acceptance of clients, procedure for identifying the clients and transaction monitoring and reporting.

- Tackling tax havens: There is a need to draw a line between financial confidentiality rules in certain countries and these financial institutions becoming money laundering havens.